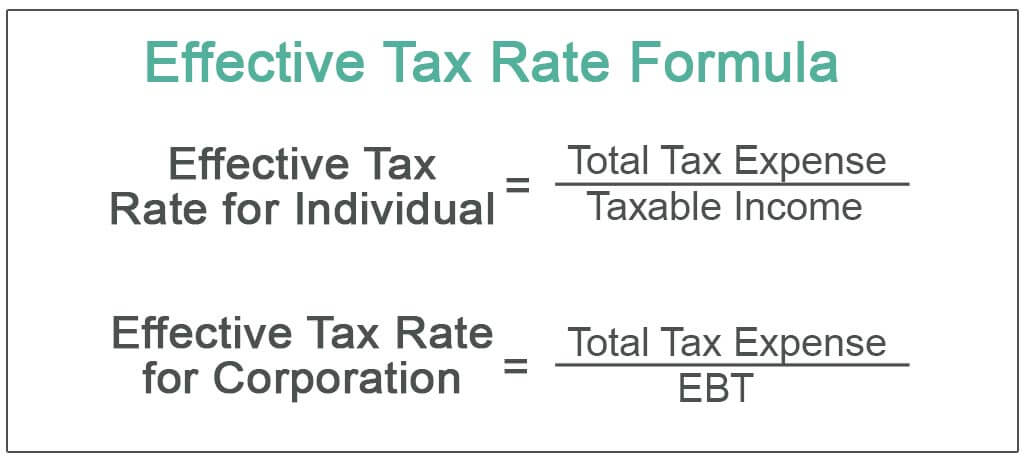

Effective Tax Rate Formula

To calculate your effective tax rate you need two numbers. VLOOKUP requires lookup values to be in the first column of the lookup table.

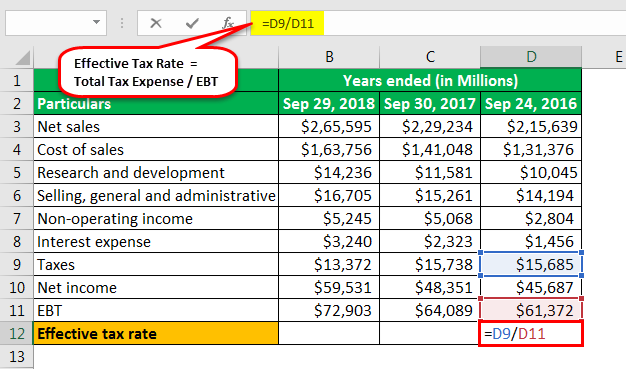

Effective Tax Rate Formula And Calculation Example

Total Effective Rate Maximum Cost Per Employee.

. Discount Rate 698. Recent legislation changed Floridas reemployment tax rate computation for rates effective 2021 through 2025. The combined rate calculated by Revenue Jersey cant exceed the following.

Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax rate. Tax Rate 2083. Contributions Maximum combined tax and LTC rate.

In the US taxpayers Taxpayers A taxpayer is a person or a corporation who has to pay tax to the government based on their income and in the technical sense they are liable for or subject to or obligated to pay tax to the government based on the countrys tax laws. Projected benefit costs for the year base rate. Tax Shield Deduction x Tax Rate.

Basic Tax Rate calculation with VLOOKUP. The effective annual interest rate is the interest rate that is actually earned or paid on an investment loan or. 1 The type of taxing unit determines which truth-in-taxation steps apply.

At this point lets take note of the difference between the proposed effective tax rate of 25 and our calculated effective tax rates. South Carolina laws governing the tax rate assignment do not. The effective tax rate in G7 is total tax divided by taxable income.

B5 rate If FALSE the formula applies the tax. Electronic Reporting of Wage Statements and. This is usually the deduction multiplied by the tax rate.

Using the example above the effective tax rate can be calculated as. The total amount paid in taxes in 2021 and your taxable income in the same year. Withholding Formula and Instructions.

Tax rate schedules adjust automatically each year based on a formula that considers the. Hawaii County Surcharge on General Excise Tax and Rate of Tax Visibly Passed on to Customers Effective January 1 2020. John joined a bank recently where he earns a.

Discount Rate Formula Example 3. Interest Tax Shield Example. The tables are available in PDF and Excel format.

Cities counties and hospital districts may levy a sales tax specifically to reduce property taxes. Therefore the effective discount rate for David in this case is 698. This is calculated separately and the contribution is sent by Revenue Jersey to the long-term care fund.

The amount needed to pay your long term care contribution is also added onto your effective rate. Reemployment Tax Rate Computation Effective 2021 through 2025. View 2021 Withholding Tax Tables.

Your effective tax rate takes into account the total tax you paid in the year to both the federal government and the provincial government. Firstly determine the MPC which the ratio of change in personal spending consumption as a response to changes in the disposable income level of the entire nation as a whole. Let us take the example of John to understand the calculation for the effective tax rate.

Effective tax rate typically applies to federal income taxes and doesnt take into account state and local income taxes sales taxes property taxes. Anticipated Rental Motor Vehicle Surcharge Tax rate change to 5day effective July 1 2019. The formula for calculating the rate combines three major factors.

Effective January 1 2022. G5 inc returns 137. Plus Divided by Taxable income.

A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. Marginal Tax Rate US. The formula for tax multiplier can be derived by using the following steps.

Effective Annual Interest Rate. Read more are bifurcated into seven brackets based on their taxable income. The individual benefit ratio makes up the greatest portion of the employers final tax rate.

Your 2021 effective tax. Revised Hawaii County Fuel Tax Rate Effective July 1 2019. The effect of a tax shield can be determined using a formula.

Because the first column in the example is actually Band we are. In our scenario 17000 of their withdrawal is non-taxable cost basis the other 68000 falls into the 0 tax bracket leaving them with a federal income tax bill of 0 and an effective federal tax rate of 0. To learn more launch our free accounting and finance courses.

View tax tables for this tax years wages here. Let us now take an example with multiple future cash flow to illustrate the concept of a discount rate. The government changed the exchange rate formula from the last day of a fortnight to an average of two weeks something that has irked both the OMCs and refineries as the decision would lead to a.

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Effective Tax Rate Definition Formula How To Calculate

No comments for "Effective Tax Rate Formula"

Post a Comment